Robotics: A Product Selection Problem

the consensus, sequencing specialised robots, founder profiles, and a singular meme

At Nomads, we’ve been trying to find and partner with the best investors for the better part of the last two and a half years. We had a hunch some of these people would be looking into robotics. As we wrote this time last year in LPs Guide to Venture Funds:

“Despite the talent shortage, much of deep tech is benefitting from tailwinds resulting in a lower cost of capital and structurally better unit economics (for example, robotics). Although this all looks pretty consensus, it doesn’t mean everyone will be able to invest here well. There is a bottleneck investing at earliest stages - there are high information and network barriers which great GPs can exploit”

To find these GPs we’ve been looking bottoms-up in certain talent pools, speaking to founders and investors, and trying to understand what common takes are for GPs to index on. It seems the consensus outside-robotics take is “capex heavy, hard to scale, small TAM”, the consensus inside take is “scaling laws hold, full autonomy, humanoids, El Segundo, lab-spinouts, 1:1 domain-transfer from LLM learnings”.

Below is a bit of noodling on the specialist-robotics take: on using robots more to create a business edge than a frontier technical one (which we think will both accrue a large portion of value, and is under-appreciated by the consensus).

The consensus shift

The consensus take three years ago was that robots are these CapEx heavy things, that the markets for them are really only a handful of industrials - most of whom are already fully automated - and that the scaling requirements of a production line can’t really be venture scalable.

Three years later and some of the largest rounds are raised by a specific brand of robotics companies. The commonalities here: they’re raised from funds with billions to deploy, they’re founded by repeat luminary founders (Figure , The Bot Company, Collaborative Robotics) or pedigreed professors from some of the top labs in the world (Skild, Physical Intelligence), or sometimes, they’re just also building fully autonomous general purpose robots (1x, Agility, Unitree, bot.co, Mentee, Sanctuary).

The argument for these companies goes something like this:

The TAM is enormous (literally, all of labour)

The tech is progressive. We can get to a reasonable amount of autonomy ourselves, and then through partnering with incumbents (say, Figure and OEMs) we can get the reps in to train our model, while our investors (like OpenAI and Microsoft) provide compute and help us build the model.

We need to raise a ton because it’s a race to robotic AGI and the one who gets there first wins

While this is compelling, it’s also a function of capital and narrative dynamics. As ever, Mike said it well:

“The reality of venture capital in 2024 is that funds are incentivized in some way to figure out where they can spot absolute upside as well as areas that can absorb the scale of capital that fit within the model of selling 10-30% of a business per round.

Robotics has been chosen as a prime candidate that satisfies the second-order effect of being a massive opportunity, as well as this framework of putting dollars to work, and even better there have been a very low number of startup competitors over the years in this space that have survived”

Whether or not this is the most value accretive strategy isn’t really too interesting for us as LPs. It’s nearly impossible to return a fund 10x when you’re managing $2bn and investing in Skild at $1.5bn caps. Contrast that with say, Compound investing from a $50m fund into the single-digit post-money seed rounds of Wayve (which just raised $1bn from Softbank) or Runway (raised $450m from GA).

The competition, mountains of cash, and difficulty for small funds to compete here all make chasing the holy grail of robotics foundation models a hard place for us to play in. We don’t think the specialist robotics take is necessarily adverse selection either.

Sequencing specialised robots

In the book, The Box, Marc Levinson talks through the shift from OpEx to CapEx that took place in the shipping industry when they started using containers. Previously, ships would hire tons of people to offload and load, shipping space was prohibitively expensive for smaller trading companies, and most boxes were for one-off use. Standardising containers meant immense sums of investment, but also now standardised port infrastructure. It meant less labour for handling as cranes can churn through these things and now small businesses can rent out boxes by the part. We see a similar shift from OpEx to CapEx taking place in automating physical industries.

Monumental

The first key insight is to look for markets where customers don’t really care if it’s oompa-loompas doing the labour or robots. The robots then aren’t the selling point themselves, they’re just more efficient. For example, Monumental isn’t really a robot company, it’s a subcontractor with automated bricklayers. They offer the same product, in the same time as other subbies, but with more reliable uptime (the key consideration for most buyers). The robots are a fair bit cheaper than a human’s wages, and even sub-scale can run at software-like margins in a volume industry

In some ways we see this as a return to 2010’s commercial focus. A quote from Vikas Enti, who led Kiva's integration at Amazon:

“At the time, a lot of people said that using barcodes to ‘cheat’ and localize robots meant that Kiva Systems didn’t really do advanced robotics. But that’s not how the market saw it. The market saw fleets of hundreds of thousands of robots with high uptime moving around without colliding, which added real economic value. The truth is, we as technologists fall into the trap of focusing on tech novelty versus business value.”

The reality is full automation is a bit of a fairy tale. Getting there is constrained by diverse sets of training data, which is constrained by getting a variety of reps in. So however you choose to go-to-market, you need to have some way of rapidly iterating. Usually this is the combination of low implementation costs, a cheap bill of materials, a fragmented and densely located market (Amsterdam - where Monumental is - is a tiny place with a lot of brick houses), and changing as little as possible in the supply chain.1

The second key insight here is to sequence the product. The SpaceX example is a bit trite, so take Zipline (drone delivery, valued at $3bn) and Gecko (industrial inspection robot, valued at $630m).

Zipline

Paul, who invested in Zipline at $30m cap, puts it like this: Back in the day, Rwandan air regulations were a lot looser than the US’. So Keller Rinaudo Cliffton, the founder, heads to Africa to go train some drones. It’s a super simple drone to start, and they hadn’t solved all the intrinsic regulatory and technology challenges out the gate. It was making money though, selling delivery to rural healthcare providers. It also wasn’t fully autonomous as landing was tricky and doctors didn’t want to operate these things, so instead of over-engineering, they just dropped a box with a parachute.

Over the last five years, Zipline has worked with regulators to open in the US and UK, and has branched from blood deliveries in Rwanda to e-commerce, groceries, convenience shopping and more in the more developed countries. They’ve built up fleet management software, know the last-mile logistics demands of their clients, have predictive weather forecasting systems and orchestration layers upon on orchestration layers.

Gecko

Gecko’s is a classic ‘observe and manoeuvre’ robot. It inspects infrastructure, like energy plants and refineries, for cracks and such, replacing the man hours of setting up scaffolding, climbing up, looking by eye, and writing on notepads while dangling by rope. It’s an interesting case in market selection driving product decisions.

In 2013, when they were started in Jake’s college dorm, power plant regulation had changed to mandate a total shut down when inspecting the plants. This would take 2-3 days and cost the plant roughly $1m/hour. Gecko could cut this to one day. What they cracked was selling the service and having a ton of pricing power in doing so. However, there’s not a ton of power plants, and they don’t need a ton of inspection, so Gecko began to upsell the data and branch into other industries. They hired a ton of engineers from Palantir, began to create digital twins of the infrastructure they inspected, and called this product Cantilever.

Nowadays many robotics companies want to become the inspectionOS or droneOS. But wedging it from a niche market, where you don’t overbuild, and incrementally sequence the product feels more a product and market selection problem than it does a tech or ‘how can I build a foundation model’ one.

Amazon Robotics

Brad Porter has written three great pieces about their approach at Amazon. Some bastardisation by me:

“[our approach at Amazon was]… focus on understanding what robots are capable of today, deploy current state-of-the-art robots at scale quickly, and then leverage the advances in machine learning and AI to further improve and streamline the operations”

Paraphrasing his playbook:

“Don't build complex fully mobile robotic systems with expensive components to be 'general purpose', instead build with simple off the shelf components and doing as much as you can in software. Build what you need to build to get into the field with a working, cost-effective solution as fast as possible (preferably <24 months)… Building wheels is easy manoeuvrability… designing the robot around the placement of batteries, assuming no battery improvement, and building self-swap-in keeps runtime up. Investing in simulation to provide the foundation for more generalised controls as techniques evolve…”

Then, on scaling (also informed by discussions with Salar):

Don’t scale production until you’ve proved positive ROI or cash flow on the cost of an individual robot, work with commoditised hardware and focus on building as cheap as possible, and everything in-house. Scaling ultimately must look like car manufacturers - robots building robots. These can be bought, though will require large scale supply chain investment.

Founder profile

Another commonality between Gecko and Zipline is that both founders were young tinkerers. Jake bootstrapped Gecko from college. You can hear him talk to Jason Calacanis about the journey here. He had his bachelors in engineering but certainly wasn’t the masters-level tech guy. Similar story for Keller - he studied biotech at graduate level, joined BCG after college, then left after 2.5 months to build a toy robotics company before pivoting it a couple years later to Zipline. Neither had a ton of pedigree.

Out of the lab

The consensus take seems to be that academic founders (like Peter Chen and Pieter Abbeel of Covariant, Alex of Wayve, Ilya Sutskever, or Matanya of Amp) are still the best types today to bring about the next generation of robotics companies. This might make sense for the frontier foundation-model approaches, but for the specialist approach maybe less so. The emergence of open source vision software, tooling, and commoditised hardware make it a lot easier to start a robotics company today, a dynamic we wrote about here.2 The problem isn’t the tech, the problem is finding the customers and going to market thoughtfully since most markets and workflows aren’t built around the inclusion of robotics. Today, we think the shift has been out the labs and towards more generalist people, perhaps with B+ ML understanding.

Young tinkerers

Alternatively, the next wave of robotics companies comes from young Zipline-like tinkerers. People like, Saif at Shinkei, Jonas at Daedalus, and Zach at Coco are running this ‘sequencing specialist robotics’ approach today. A lot of them are coming from programs like ZFellows, Prod, and Disciplus (William at TUNL). They might have Emergent (Alex at Tau), Magnificent (Harry at HOCC) and Thiel Fellowship (Charlie at Orchard Robotics) grants. They might’ve gone through YC (Kenneth at RMFG, Ros at Adagy, Danush at Clone). They’re young, technical, scrappy, and folk like Molly*, Carlo* or Koko* will hopefully find them among their peers.

Product centric

If we’re right, and the next wave is product-problems, the companies will likely started by product-centric founders. Some examples of these guys are Salar of Monumental, Chiu and James at OpenShelf, Avi at Finally, Stefan at Polymath, and Arye at Elementary. These are folk who’ve sold software businesses before, they know how to do deep discovery and structure teams for speed and iteration. Hard to know what it is, but here it’s easier to know what it’s not. It’s likely not someone senior from ABB, Boston Dynamics, or any of the other first-gen robotics comapanies. It’s likely not a mid level manager leaving an enterprise company. It’s likely not a VC.

Counter-examples

Then there’s folk like Kyle Vogt (ex Cruise), Eliot Horowitz (Viam, ex CTO MongoDB), Chris Walti (Mytra, ex Tesla Optimus Lead), Brad Porter (Cobot, ex CTO of ScaleAI and VP Robotics at Amazon) and Tony Zhao* (CS PhD, Stanford, published ALOHA paper) with incredible pedigree. These folk are widely covered by big brand VCs and are priced as such out the gate. Unless you’ve befriended these people exceptionally early - which, likely you haven’t - it’s usually easier for investors to look elsewhere.3

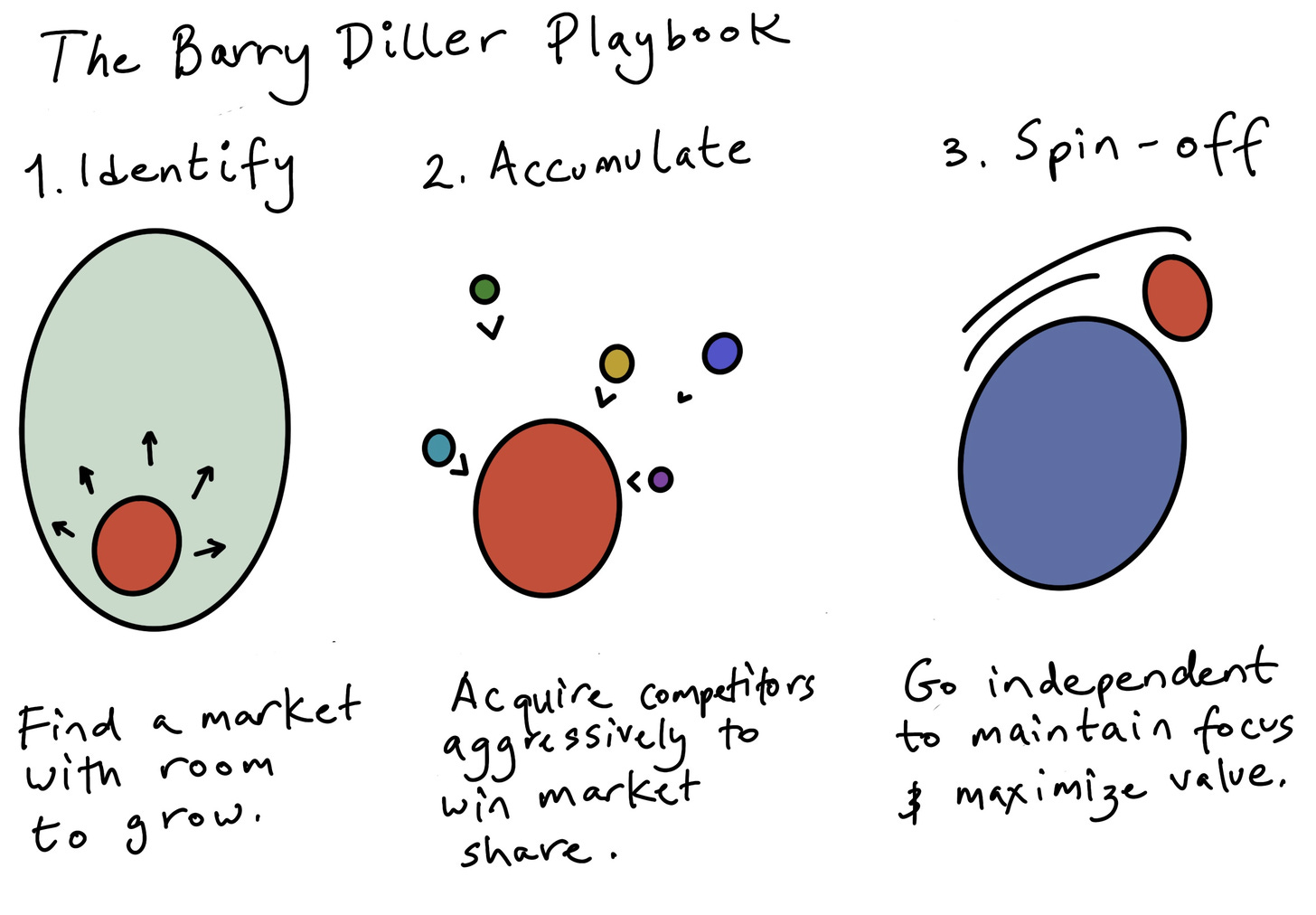

Diller style rollups

Robotics is ‘just’ automation of labour. The moat is still a business moat, created in the early stages by deeply getting your customer. Yet often we see investors indexing more on the best technology and underweighting the focus or unique insight the founder has on the end-customer problem. One framing of this is the Diller style rollup.

Companies like Sun Day* (automated car wash) or to a lesser extent Dentologie (dental franchise)* are already modelling the verticalisation by bundling individual practices into single entities, automating the back-end, and giving much better customer experiences. In the last couple months, we’ve started to see some private equity firms targeting industrial style, low-tech, high-fragmentation, high-volume companies and using robots to automate the labour shortages.

Given the number of robotics companies that have been started, have had a long gestation period building IP, and have struggled to monetise, it feels like there should be a decent sample pool to run this playbook.

By first finding a market and creating a customer set, then partnering with (or acqui-hiring, recapitalising, or in-housing) robotics firms to provide the tech, you can run a Barry Diller style rollup, albeit with robotics instead of online businesses. The secret, as Modest Proposal described, is that IAC is "maniacally focused and maniacally talented at taking a product and figuring out ways to bring users to it in an economically efficient manner.”

It’s product-selection all the way down

“Technological development and scale are not the only aspects of a company’s activities in which unusual circumstances may raise opportunities for sustained high profit margins. In certain circumstances these can also occur in the area of marketing or sales ... First, the company must build up a reputation for quality and reliability in a product (a) that the customer recognizes is very important for the proper conduct of his activities, (b) where an inferior or malfunctioning product would cause serious problems, (c) where no competitor is serving more than a minor segment of the market so that the dominant company is nearly synonymous in the public mind with the source of supply, and yet (d) the cost of the product is only a quite small part of the customer’s total cost of operations ... Second, it must have a product sold to many small customers rather than a few large ones. These customers must be sufficiently specialized in their nature that it would be unlikely for a potential competitor to feel they could be reached through advertising media such as magazines or television. They constitute a market in which, as long as the dominant company maintains the quality of its product and the adequacy of its service, it can be displaced only by informed salesmen making individual calls. Yet the size of each customer’s orders make such a selling effort totally uneconomical! A company possessing all these advantages can, through marketing, maintain an above-average profit margin almost indefinitely…”

You’d be forgiven for thinking the above is a modern robotics startup. It’s actually from Phil Fisher’s 1957 classic Common Stocks and Uncommon Profits, talking about Texas Instruments (with emphasis mine).

Product and market selection have contributed to TI’s moat far more than frontier semiconductor progress. The company’s ability to generate huge revenue with minuscule R&D and S&M lies in its customer relationships. They have the broadest offering and so, as clients need a one-stop-shop, have the most viable shop in town. Meanwhile, their analog chips are sticky (customers design entire components around them), selling for 50 cents to a couple of bucks per piece with hundreds of thousands of SKUs.

Reframing Fisher’s take into a robotics thesis:

It’s got to be a hair-on-fire problem for customers to justify something weird like robots (like bricks in a house, getting medicine to rural villages, or regulatory-mandated inspections)

It’s got to work. Not only because it’s your pitch that it will, but also because it prevents an 80% autonomous humanoid from eating your lunch

It’s got to be a fragmented market not addressable by ABB. Selling to robots people who buy massive robots for a living is a very competitive ask

Cost cannot be a barrier to entry (Monumental charges parity with manual bricklayers, Zipline’s blood bank delivery was 5x cheaper and 21x faster, Gecko saved $100k’s immediately)

Of course humanoids are cool. They’re just likely not going to solve all of the above in a cost effective way, and - by the time they’re cheap enough and fully autonomous - there’s likely to be a bunch of businesses with specialised robots inside, led by creative product-centric people, already with deep business moats around them.

Big thanks to Salar, Will, Mike, Cornelius, Patrick, Kevin, Koko, and of course Wouter, Yavuzhan, and Siya for the chats that’ve gone into this.

*Nomads portfolio founder or GP

Teleoperations also works to take the robot from “sensor + dumb arm” to “human-out-the-loop”. It’s great for some use cases, say for home-cleaning (Prosper, Reflex) or fixing broken robots (Adagy, Olis). But unless you can quickly shift the teleoperator base out to the Philippines and scale production quickly, it’s usually a very costly endeavour.

Like NYU’s Dobb-E, and Google's robotic transformer models RT-X, or the genAI CAD tools like Jitx, CloudNC’s CAMassist a co-pilot for machining, Zoo’s text-to-CAD design tool, or Generative’s parallelised design engine.